The Rise of the Millenipreneur

The health and pricing of luxury real estate markets are not always internationally fueled; the spending habits of local entrepreneurs also have an influence. Increasingly, where affluent millennial prime property buyers are to be found, so too are what Scorpio Partnership recently dubbed “millennipreneurs”

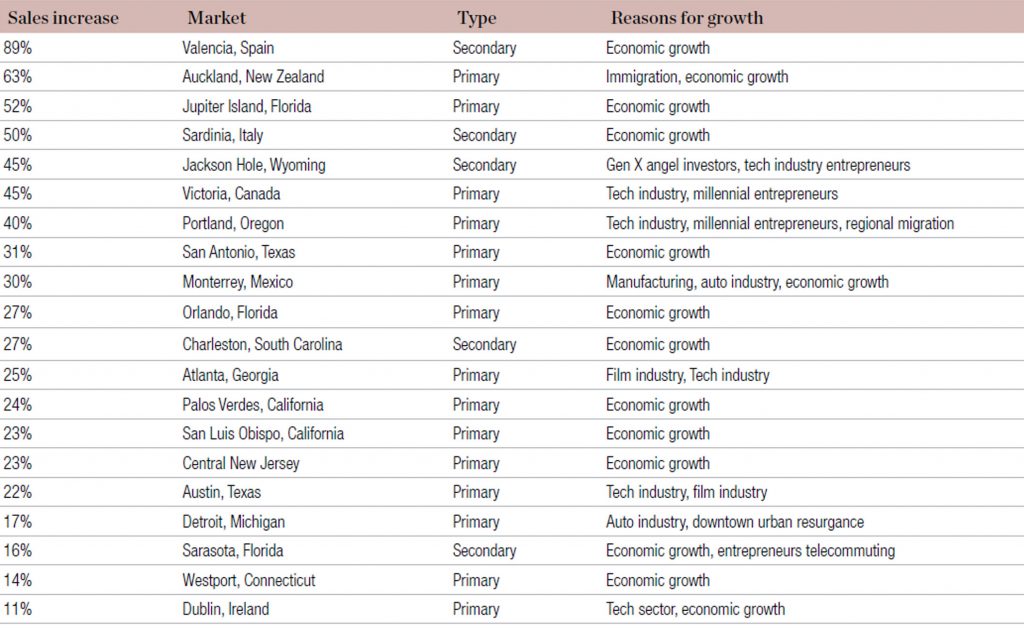

—those of the millennial generation (born between 1980 and 1995) and active in entrepreneurship. Many of the “comeback” markets that have seen an uptick in sales transactions are also seeing an increased interest from affluent millennial and entrepreneurial buyers, particularly in the lower-mid luxury tiers. Although these “millennipreneurs” frequently purchase homes in urban destinations, some are also choosing traditional resort markets with world-class lifestyle offerings as their primary residence. Today’s digitally connected business world is enabling HNWIs to employ lifestyle pursuits while still maintaining their globally connected entrepreneurial ventures. Destinations such as Jackson Hole are seeing an uptick from these buyers. “Historically reserved for the understated wealth of iconic families like the Rockefellers or global leaders like former World Bank Chair Jim Wolfensohn, our luxury home buyers are now expanding beyond the historic demographic with a different type of buyer,” says Julie Faupel of Jackson Hole Real Estate Associates in Wyoming’s picturesque town of Jackson Hole, which saw year-on-year luxury home sales increase by 45 percent.

“Still understated, Jackson has a new appeal to 30-something angel investors and dotcom sensations, as well as entrepreneurs and business New Affluent Buyers owners with young families that are telecommuting in order to raise their families in this mountain destination.” Lifestyle Arbitrage Rising prices, limited inventory, and a flurry of low-mid level luxury home sales in major urban areas have also pointed toward this new phenomenon: local buyers moving to outer boroughs if not out of the city altogether seeking a lifestyle arbitrage. In Toronto, outer suburban areas and commutable cities as far away as Collingwood are flourishing thanks to buyers armed with a windfall of disposable income from their million-dollar-plus Toronto home sales. “As it is becoming increasingly expensive for many buyers to purchase in urban markets, many families and empty nesters are moving to the Southern Georgian Bay area where they are able to purchase more affordable homes in all price categories without sacrificing quality of life,” said Diana Lea Berdini of Chestnut Park Real Estate. The phenomenon is not simply limited to urban pockets and smaller cities on the global hub fringe. High-end property markets in coastal communities are also witnessing this phenomenon. New Zealand’s North Island northeastern coastline has seen an influx of city dwellers who are purchasing luxury coastal properties after selling a high-value Auckland home. Million-dollar-plus home sales in the area have almost tripled over the past three years. Interestingly, this lifestyle arbitrage is at times being fueled by HNWIs who are flocking to areas once seen solely as second-home resort markets. Advances in technology, communication, business attitudes, and transportation are enabling HNWIs to live and work where their passions are best aligned. In New York, the arbitrage is evident in much closer confines. As trendier Manhattanites migrated to up and- coming areas of Brooklyn, the prices of closer-in areas like Brooklyn Heights, Cobble Hill, and more recently Williamsburg, have ascended to the point that Manhattan is at times being viewed as a lower-priced luxury home alternative. Recent commentary has noted the move from Williamsburg to the Upper East Side, for example, as buyers seek out more affordable per-square- foot pricing and the convenience of Manhattan living.